“There is wide variation across the Member States regarding approaches to ensuring effective and adequate coverage of social protection for artists and cultural workers”, reads the new report published by the European Commission, to present the results of the ‘Mutual learning on inclusive social protection for artists and creative workers ’, with the participation of 21 member-states and CCS representatives.

"It is really helpful and inspiring to see all kinds of regulations countries have to give artists some access to social security", said CreativeFLIP’s Joost Heinsius, who took part in the meeting and presented the This is how we work-tool from CreativesUnite, which was received as "very useful".

The workshop was part of the Commission’s answer to the EP legislative initiative from 2023 for an EU framework for the social and professional situation of artists and workers in the cultural and creative sectors, including a "Directive on decent working conditions" for CCS professionals.

From no CCS-specific provisions to an artist's pension of EUR 1623 per month

According to the report, about 7.8 million CCS professionals in the EU, almost 4% of the total workforce, experience fragmented careers, irregular income patterns, and hybrid employment status. “More than 70% of CCS professionals disagreed with the statement that they have sufficient access to social protection”.

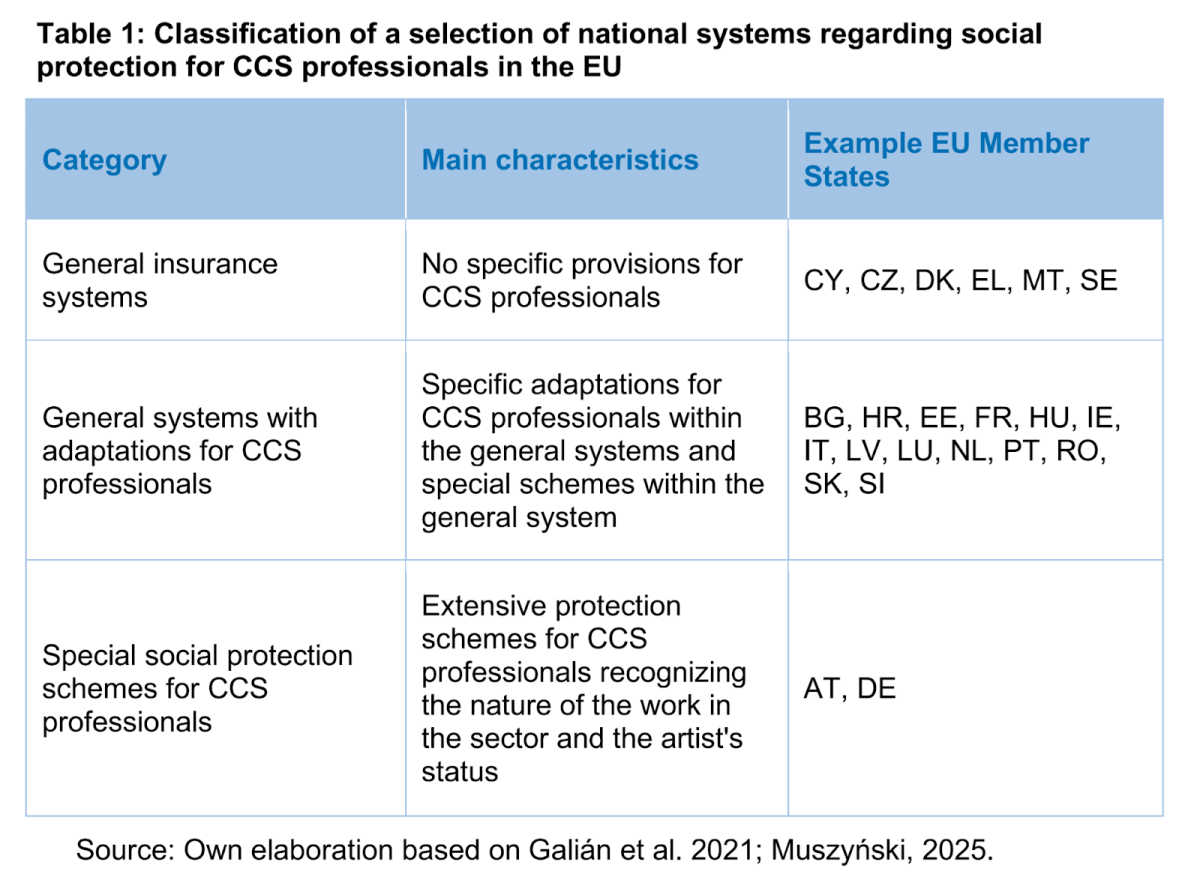

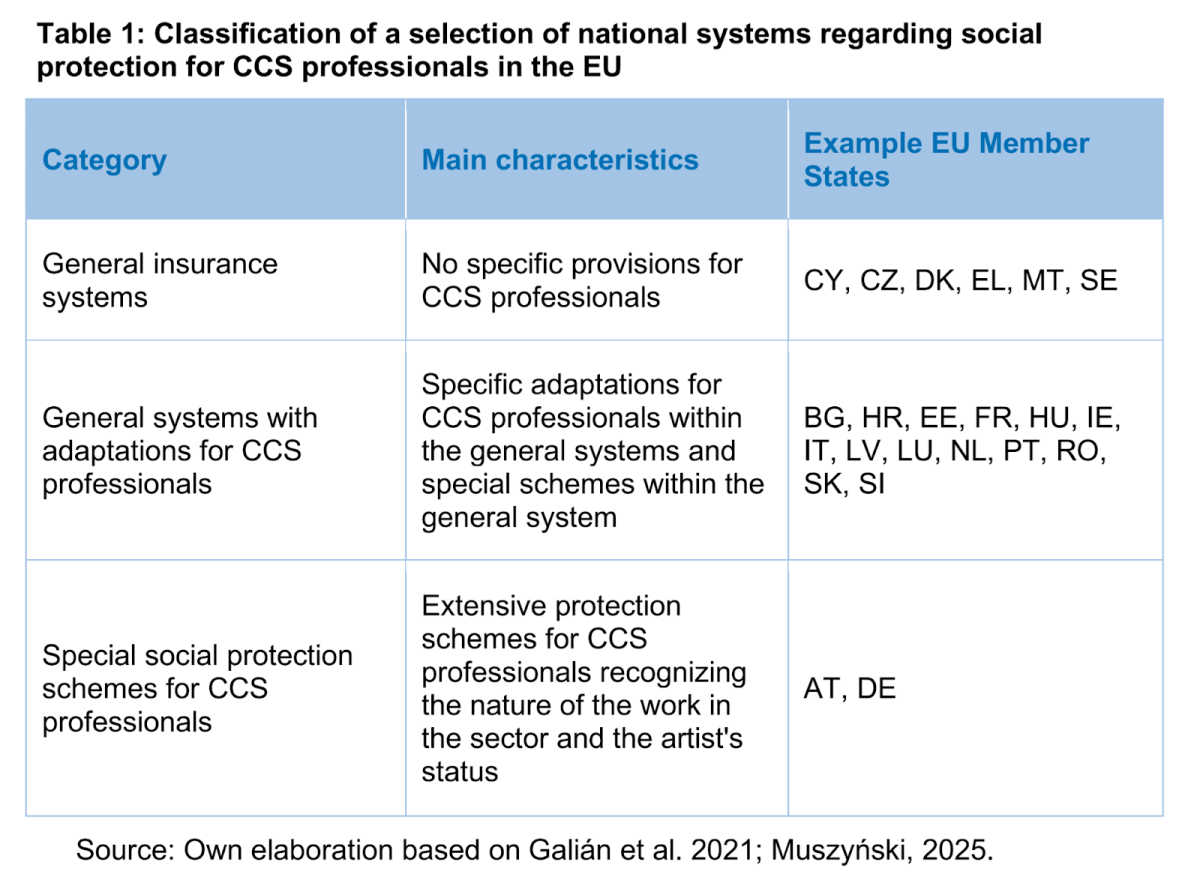

Austria and Germany have extensive CCS protection schemes, while there are countries with no CCS-specific provisions at all (click on image to enlarge).

Best-practices highlighted in the report include the following (not included in table above):

- Artists in Finland have access to a maximum amount of EUR 1623 per month as a full artist's pension. Pension award criteria include peer reviews on the artistic merits of applicants and their financial situation.

- Lithuanian artists may be granted EUR 1038 per month for a maximum of three months, as a Creative Downtime Payment, when "due to objective circumstances beyond their control, they temporarily lack the conditions necessary for artistic creation and the dissemination of their work".

- In Spain, self-employed artists with annual earnings of less than EUR 3000 are considered of low income and as such, eligible to reduced contributions.

- Germany’s Artists’ Social Insurance Fund is financed by 50% through a state subsidy and entities using/distributing art, such as publishers, press agencies, theatres or radio and television stations.

- In Belgium, a ‘Certificate of Working in the Arts’, provides entitlement to the funding and social protection schemes, such as art worker allowances, a special copyright tax scheme, and an adjusted pension plan.

- In Poland, a state-funded subsidy for social and health insurance contributions, aims to bring art professionals up to the level of the minimum wage.

Precarity of CCS employment persists

Precarity of employment is often even among those with employee status, as the sector is particularly affected by ‘bogus self-employment’ and 18.2% of CCS professionals are employed under temporary contracts compared to 13.5% in total employment.

Full-time employment (75.8%) is also less prevalent than the total economy average (81.2%), while 68% of CCS professionals hold more than one job, with 66% combining multiple roles within the CCS sector and 34% working both inside and outside of the CCS.

As precarity of CCS employment persists and countries' provisions vary, the authors of the report encourage member states to consider the examples presented when undertaking reforms to better integrate CCS professionals into national social security systems.

Find the report here

Image 1 by Pexels from Pixabay - Free for use under the Pixabay Content License

Image 2 - provided on page 10 of the report here.