“The European audiovisual services sector continues to grow”, as found in the newly published report of the European Audiovisual Observatory. The new report is titled “Audiovisual Media Services in Europe – 2024 data” and maps supply, programming, coverage and ownership trends.

Key findings include a 2% growth, an increasing interest on thematic content and high percentages of TV channels, private ownership and US presence.

High Percentages of TV channels and private ownership

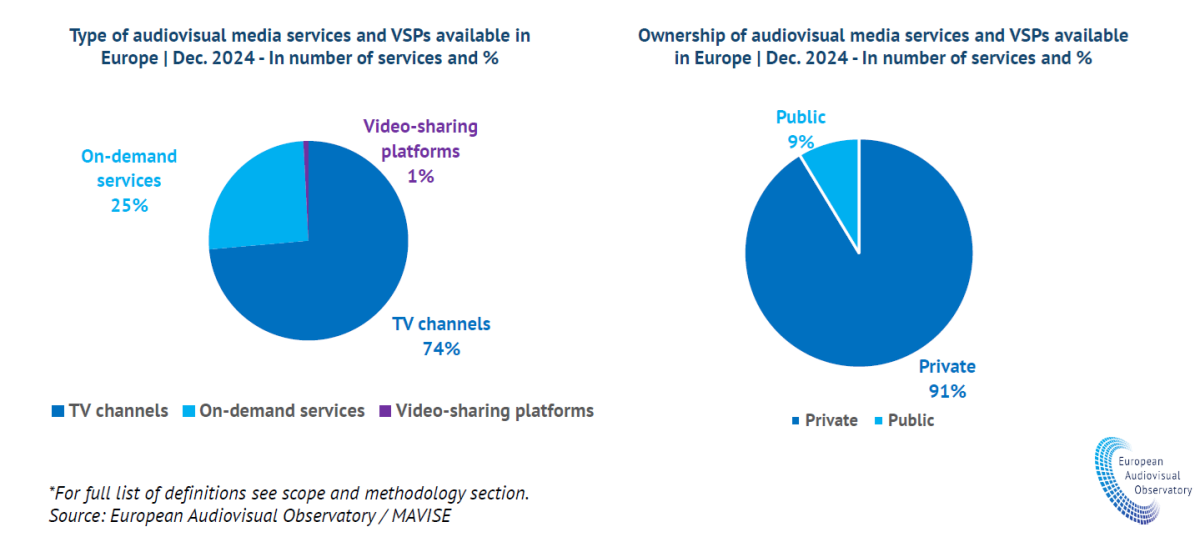

A 2% increase was observed between December 2023 and December 2024 in the number of audiovisual media services and video-sharing platforms available in wider* Europe. A faster growth was observed for On-demand services (4%) compared to TV channels (1%).

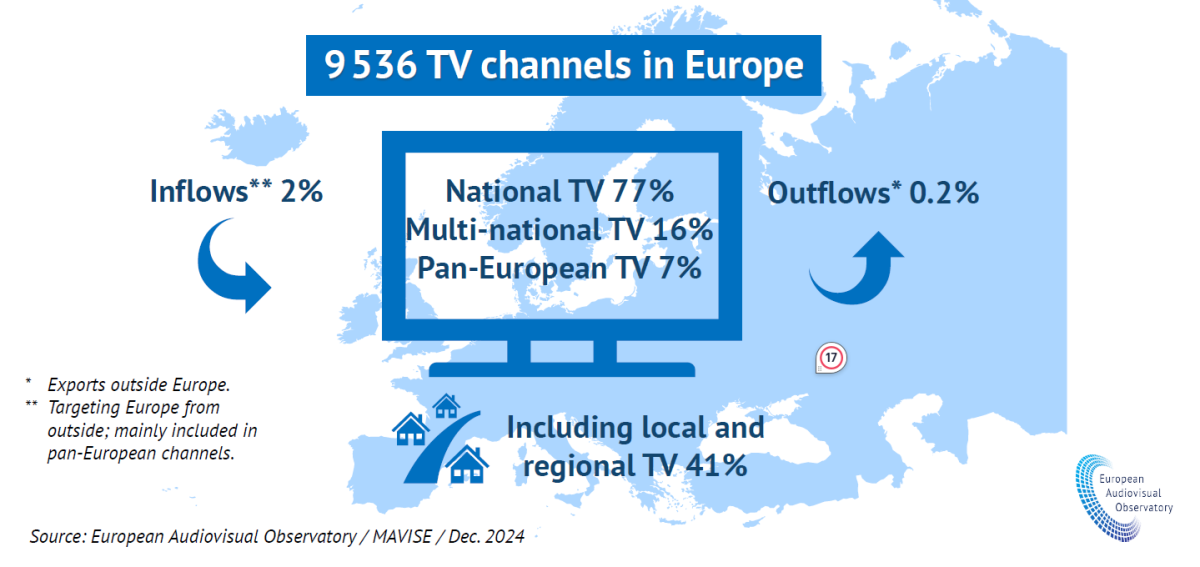

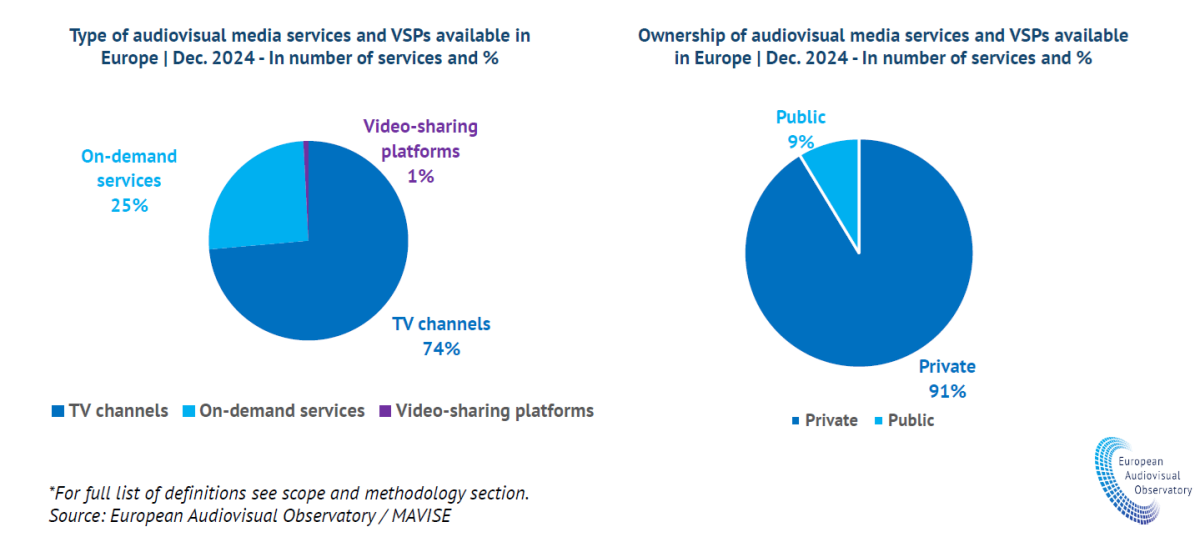

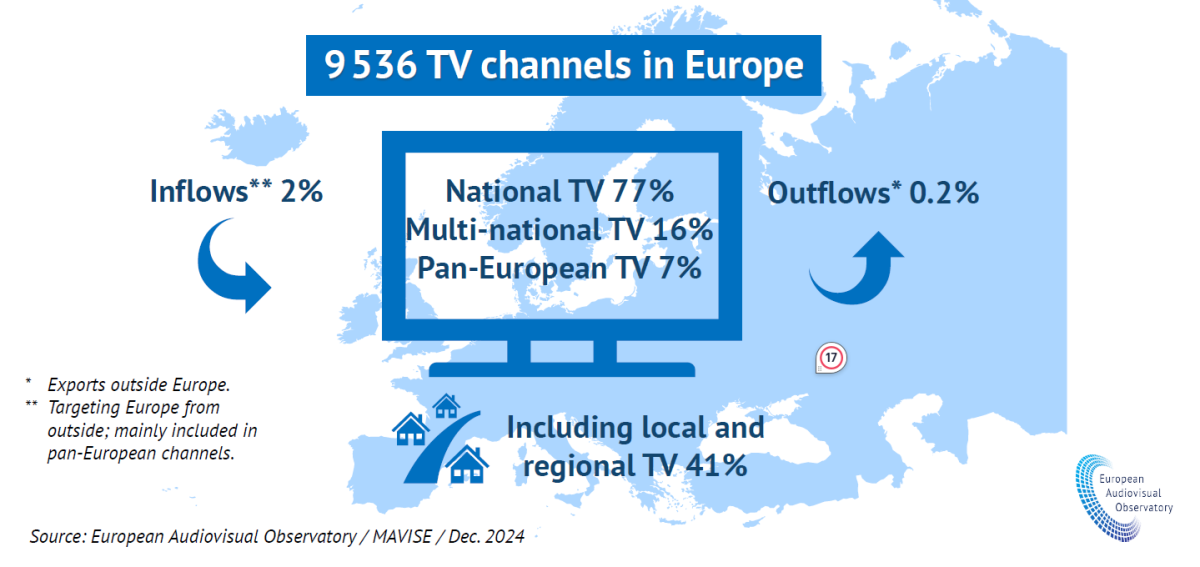

As of December 2024, European viewers have access to 12.955 audiovisual media services and video-sharing platforms. A 74% or 9.536 of those are TV channels and 26% or 3.419 are on-demand services and video-sharing platforms.

91% of the total are owned by private firms. One in four (25%) of all private European TV channels (excluding local TV) and almost one in ten (9%) of all on-demand services are of US ownership.

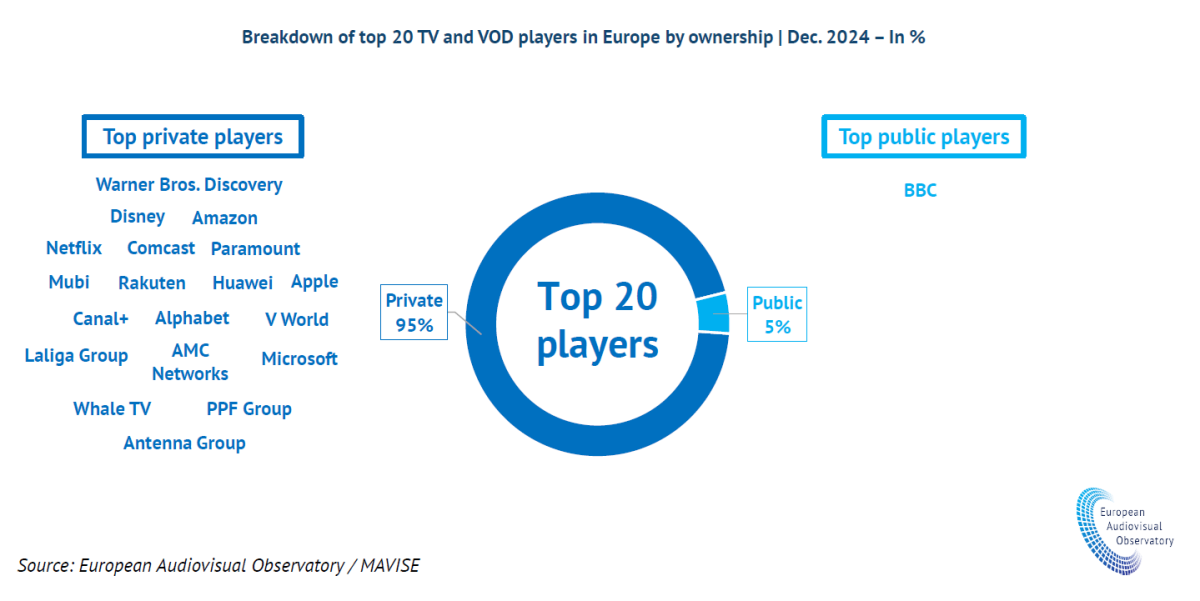

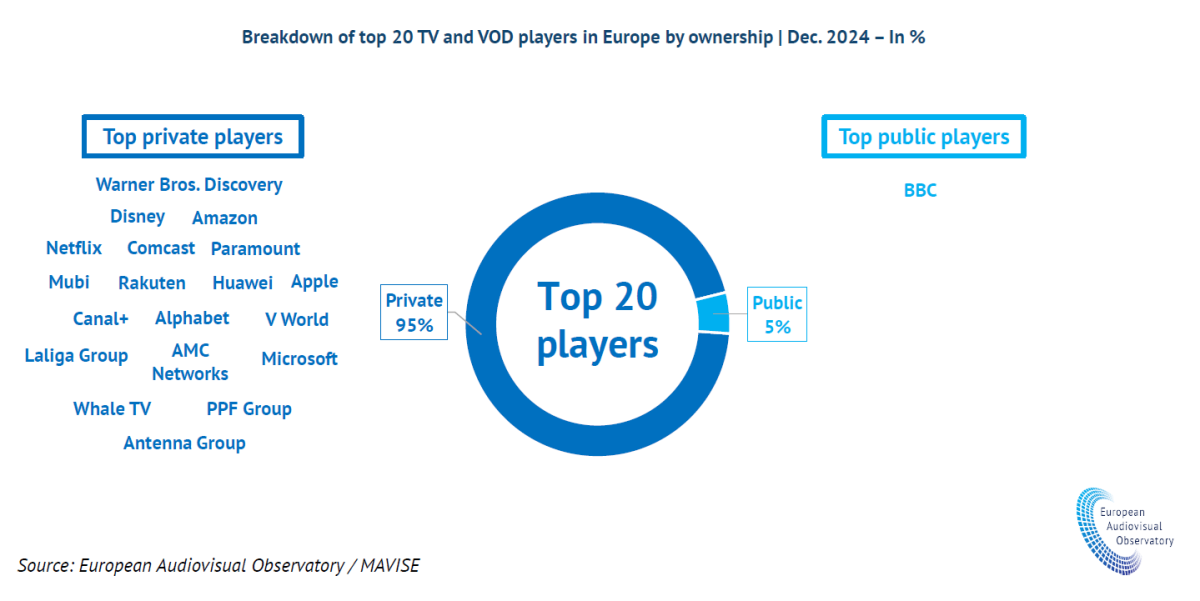

95% of Top-20 players are Private

The report presents data on the Big Picture and the Top 20 Players of the Audiovisual Services, 95% of which are private and 5% are public, which is the BBC. The report includes three case-studies over a centralized, a multi-country and a decentralized strategy, respectively NETFLIX, Antenna Group and Walt Disney Company.

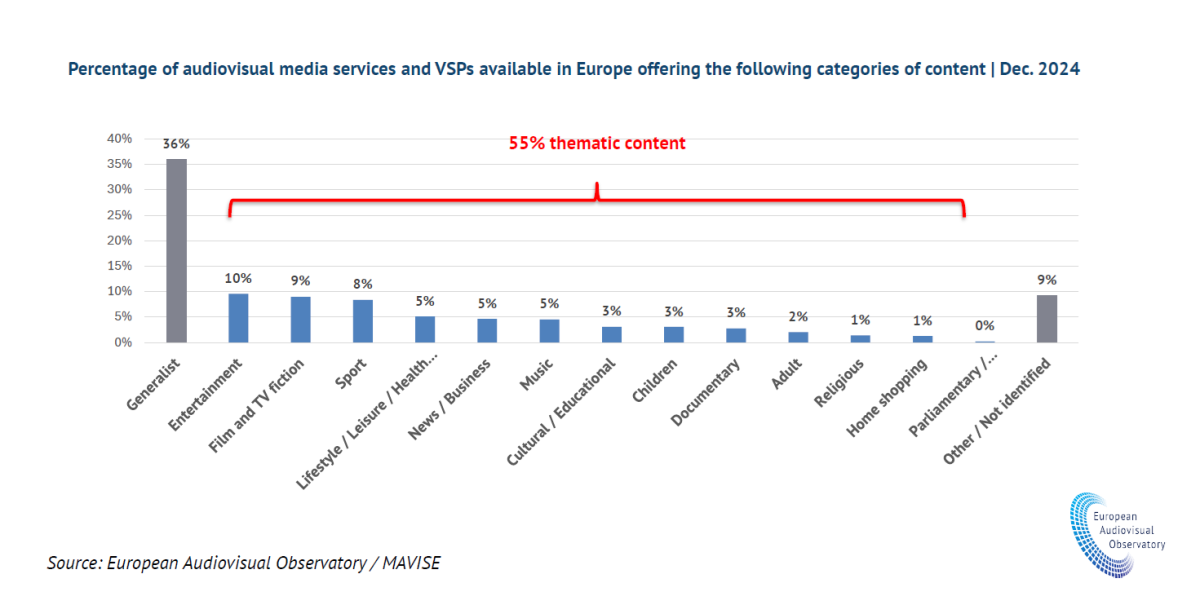

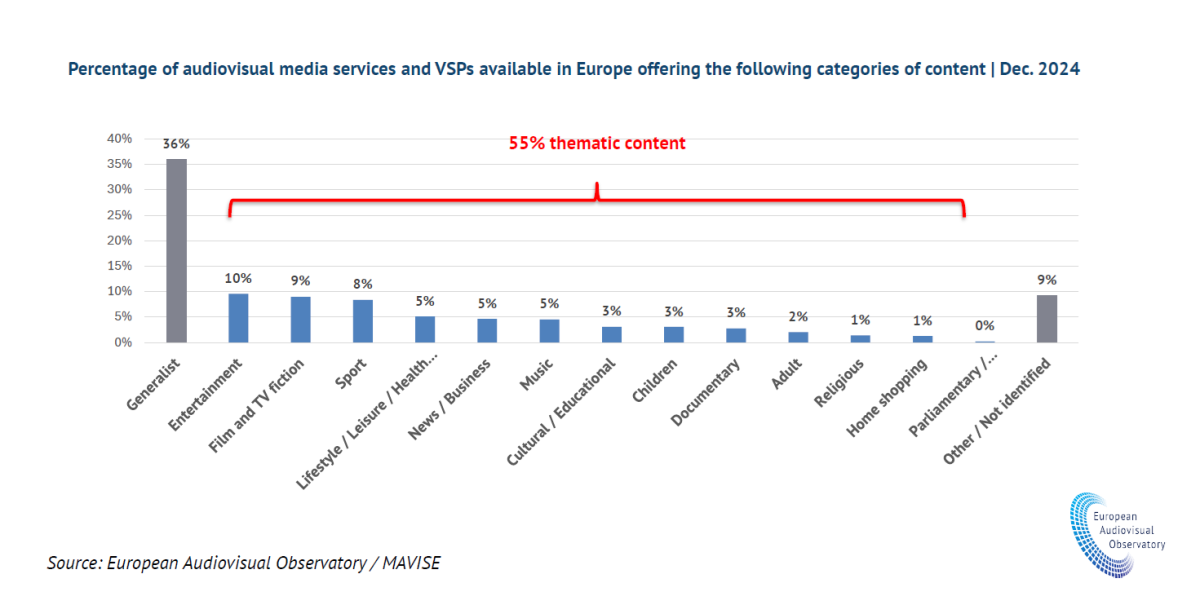

Most popular content themes are Entertainment, Film and TV fiction

At least 55% of European Audiovisual services and Video Sharing Platforms provide thematic content, where entertainment, film and TV fiction and sports appear as the most popular programmes.

High US presence, Low Exports and Low Pan-European Coverage

“US TV channel portfolios are significantly larger than European ones, with 70% of channels in the top 10 TV groups owned by five US companies” as found in the report.

Outflows reach up to the low 0.2%. A percentage of 77% of European audiovisual services cover national markets, while services with a multi-national or pan-European coverage combine to a 23% for television and 13% for on-demand services.

Background

The report is based on the MAVISE Database, which is managed by the European Audiovisual Observatory and supported by the CREATIVE EUROPE programme of the European Union.

It was authored by Jean-Augustin Tran, Analyst from the Observatory’s Department for Market Information.

*Wider Europe is defined as EU27, Albania, Armenia, Bosnia and Herzegovina, Georgia, Iceland, Liechtenstein, Montenegro, North Macedonia, the Republic of Moldova, Norway, Serbia, Switzerland, Türkiye, the United Kingdom and Ukraine.

Find more here

Image by Tatyana Kazakova - Free for use under the Pixabay Content License

Images 2-5 - Courtesy of the Report - “Audiovisual Media Services in Europe – 2024 data”.