The study on contractual practices in the EU, carried out on behalf of the European Commission, examined the contractual practices of producers in the audiovisual sector.

According to the findings, audiovisual producers face significant difficulties in their negotiations with global streamers and broadcasters, as their bargaining power is often limited. Producers, in smaller markets, find themselves in an even more precarious position.

The legal landscape offers little protection. While recent European Union directives aim to improve transparency and provide contract adjustment mechanisms, enforcement remains weak.

The study highlights a critical threat to European cultural diversity. With US-based streaming platforms increasingly controlling intellectual property, independent creators and smaller production companies face existential challenges. The research suggests that without significant intervention, Europe risks losing its rich cultural ecosystem to monopolistic corporate practices.

Researchers propose two primary solutions: extending consumer protection-style safeguards to creative professionals and establishing mandatory EU-level rules to protect creators' rights. These recommendations aim to rebalance negotiations and ensure fair compensation across creative industries.

The producers interviewed emphasised significant difficulties in establishing sustainable businesses when they do not own the rights for future exploitation, especially in cases where commissioners retain rights without fully financing productions. The findings based on the interviews with producers show that sometimes producers cannot own and exploit rights even when they are applicants and contribute public funding through mechanisms such as tax incentives or invest in the work’s development. This practice is more common under the commissioning model, where public funding contributed by producers is sometimes included in the overall production budget.

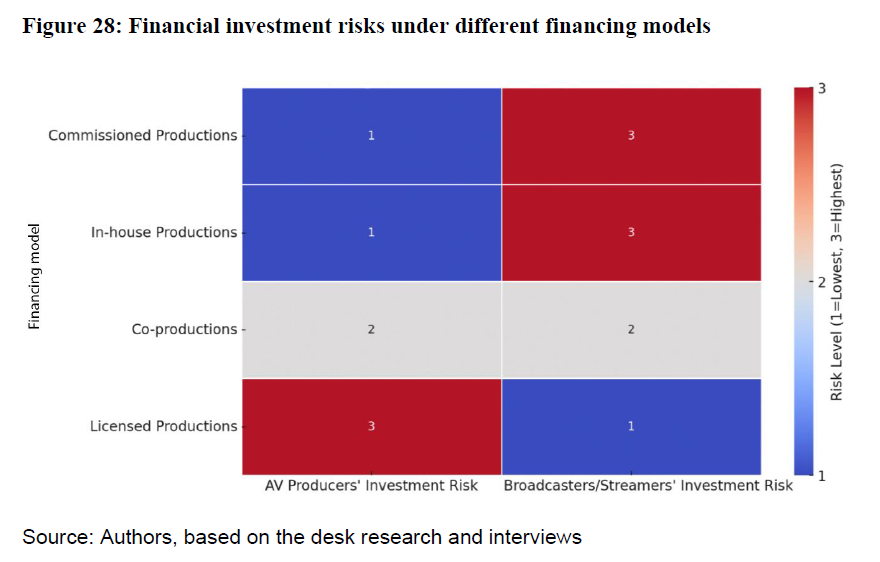

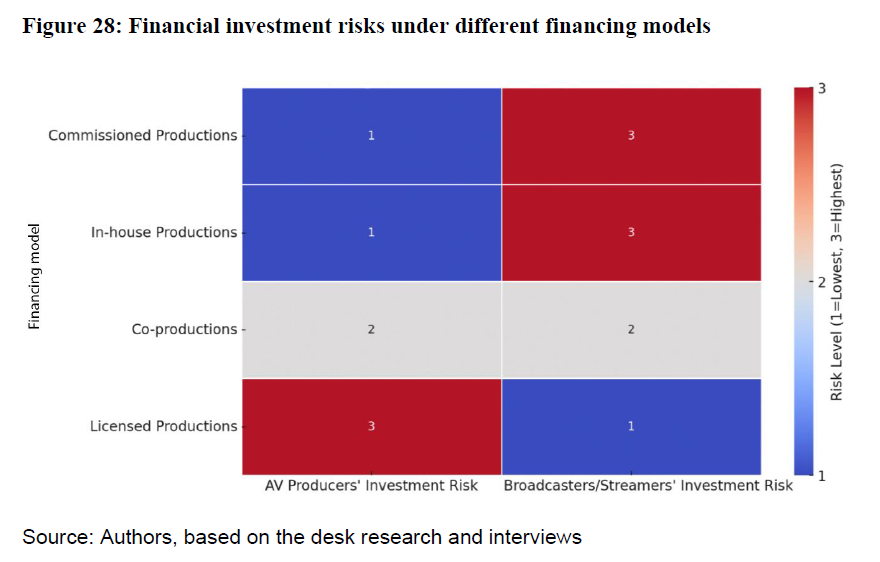

The ability of producers to own and exploit rights is often constrained under different financing models. The interviews highlighted different challenges, including contractual issues related to the choice of law and jurisdiction, limited bargaining power to negotiate turnaround clauses, and restricted opportunities for future revenues from derivative and format rights. Long licensing periods were identified as a specific issue under co-production and licensing financing models. Furthermore, producers expressed concerns over the lack of transparency regarding data on the exploitation of audiovisual works by global streamers.

The producers interviewed indicated that the commissioning model, where the financiers keep all or most of the rights, is widely used by global streamers and private broadcasters in contractual arrangements for TV fiction. In contrast, the global streamers interviewed noted a shift away from the commissioning model towards models such as licensing and co-productions, with the aim of allowing for a sharing of risks and rights in the uncertain sector landscape, as these approaches require less upfront capital investment for streamers than other cases, such as commissioning works with a full transfer of rights.

Overall, the findings indicate that various financing models coexist, with no conclusive evidence pointing to the predominance of one model. The interviews with public service broadcasters (PSBs) revealed that they primarily rely on licensing and co-production models, sometimes shaped by regulatory requirements. Private broadcasters reported that they use a variety of financing models, but emphasised that a shrinking market poses significant challenges in securing co-financiers for audiovisual projects.

The interviews highlighted that building a catalogue of rights is important for producers to establish future revenue streams and ensure the long-term sustainability of their businesses. Without rights ownership, audiovisual producers face significant limitations in investing in the creation of new works. Developing assets with long-term value is therefore crucial.

However, under the commissioning financing model where producers are unable to retain rights, their ability to grow and sustain their presence in the industry is severely impacted. The interviews with producers corroborated the findings of the European Media Industry Outlook Report (2023), highlighting a trend of including the transfer of all IP rights in contracts, especially with non-EU streamers.

This challenge is particularly prevalent for small, independent producers that are in highly vulnerable positions. The study also highlighted that the lack of protective mechanisms places producers in a weaker bargaining position, particularly when negotiating with powerful financiers that can influence contractual terms.

It is noteworthy that independent producers retain more rights when there are certain rules at national level in place that guarantee their improved bargaining position when negotiating with global streamers and broadcasters. The results indicate that audiovisual producers can secure more rights when public financing is involved, guaranteeing them certain rights based on funding criteria.

Additionally, in some EU markets, the opportunities for producers to raise capital are limited, particularly in small markets as they may not be able to get bank loans. This problem can be exacerbated because of the low number of commissioners, particularly in some smaller markets, as it can lead to cashflow challenges for the producers.

Restrictive rights agreements with streamers and broadcasters, which limit the ability of producers to secure remuneration or sustain their companies, threaten the EU’s audiovisual industries by potentially reducing independent productions and impacting diversity in content creation. In terms of impact, some interviewed producers and European broadcasters expressed concerns that the adoption of the commissioning model by US-owned global companies has shifted the ownership of the IP of European works away from European entities. According to the insights gleaned from the interviews, the inability of producers to own IP rights also affects the diversity of European audiovisual works, the availability and full exploitation of such works, as well as the diversity of the production companies.

--

photo credit: Tamara podolchak

photo source

EU study: Unfair remuneration for creators and threat to cultural diversity from transfer of IP rights to non-EU streamers

Without significant intervention, Europe risks losing its rich cultural ecosystem to monopolistic corporate practices, the research suggests.

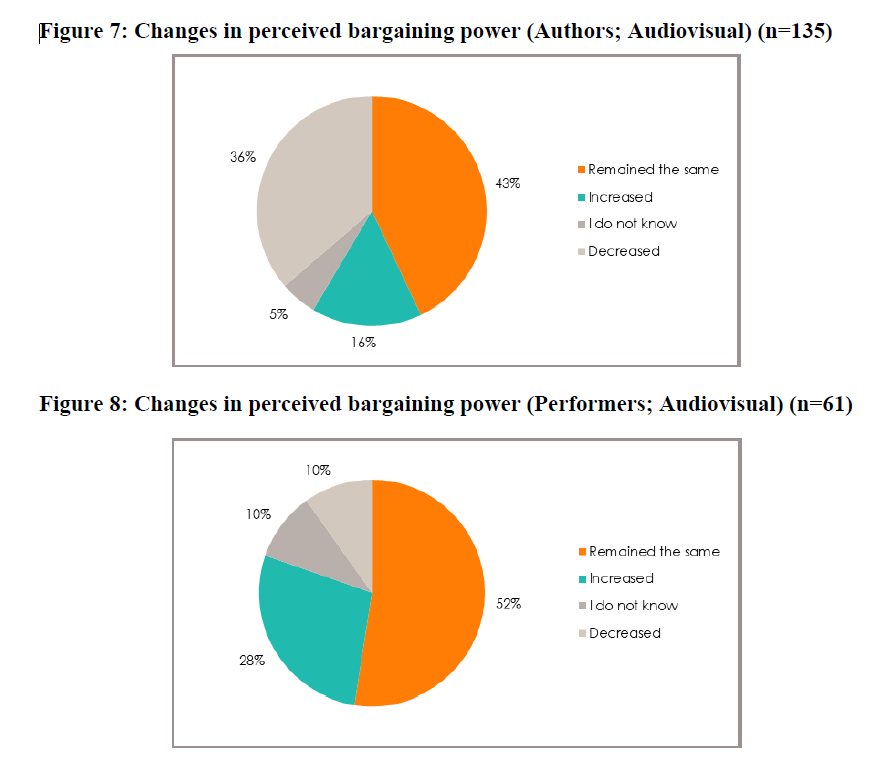

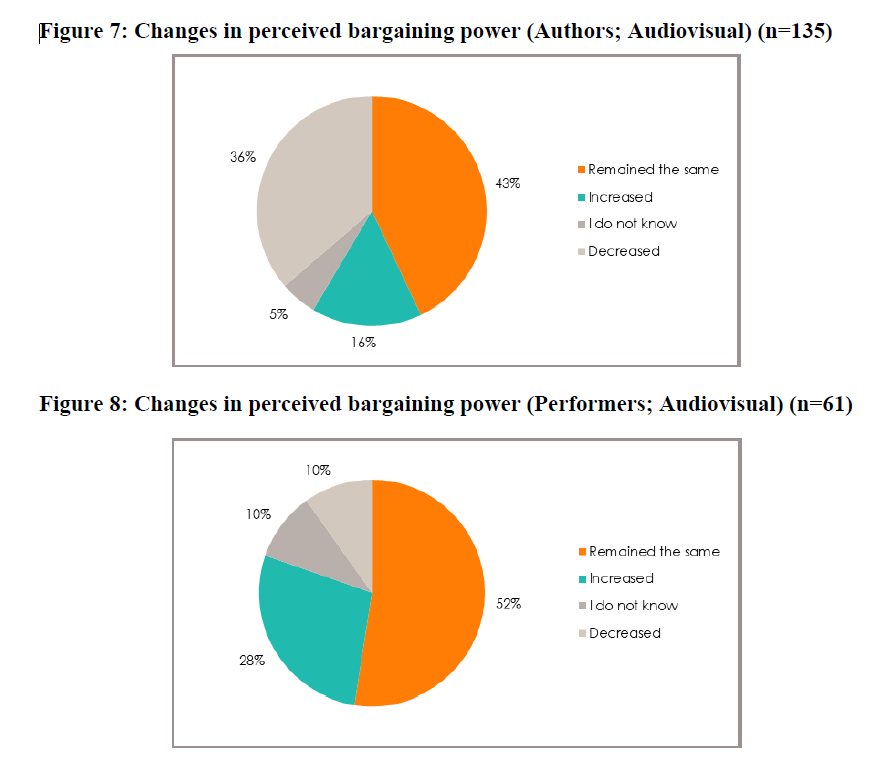

The weak bargaining power of creators in the audiovisual sector and the stronger bargaining position of performers due to collective agreements concluded by trade unions is highlighted in a new study carried out by a consortium of research organisations on behalf of the European Commission. According to the study, most authors and performers interviewed or surveyed believe that the remuneration they receive is not fair because of the rules governing the transfer of rights.

The same study also highlights the particular difficulties audiovisual producers face in negotiating with global streamers and broadcasters, as their bargaining power is often limited. According to the study, this poses a critical threat to European cultural diversity. With US-based streaming platforms increasingly controlling intellectual property, independent creators and smaller production companies face existential challenges. The research suggests that without significant intervention, Europe risks losing its rich cultural ecosystem to monopolistic corporate practices.

The research paints a stark picture of power imbalances in creative sectors, with creators consistently reporting unfair contractual practices, particularly when negotiating with global streaming platforms and major entertainment companies. From music and film to visual arts and literature, professionals are struggling to receive fair compensation for their work.

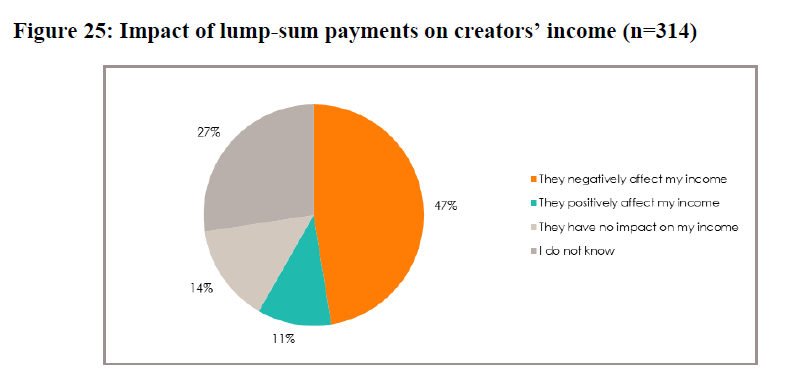

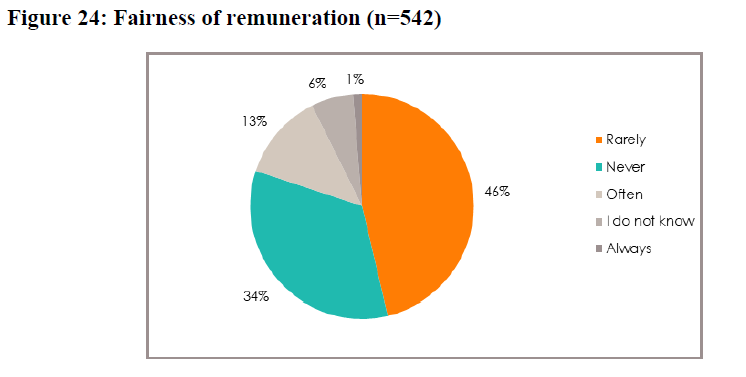

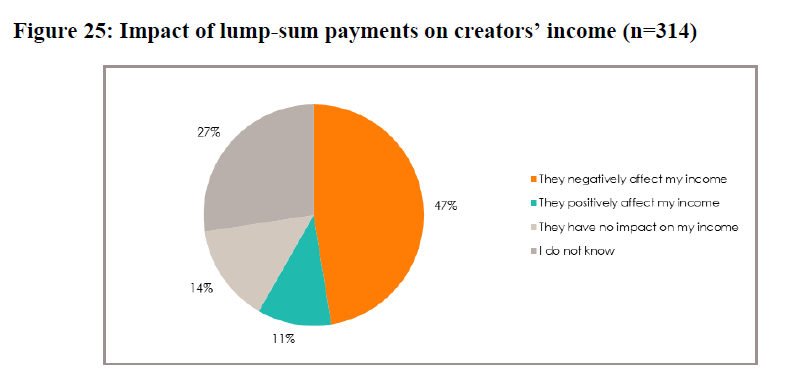

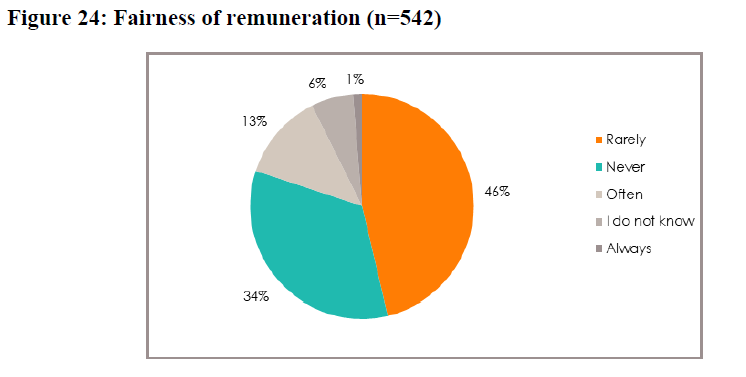

In the audiovisual sector, more than half of the creators surveyed believe their remuneration is rarely fair. Typical contracts involve lump-sum payments negotiated before a project's potential can be fully assessed, leaving artists financially vulnerable. Musicians face similar challenges, with nearly half reporting inadequate compensation and diminishing bargaining power against record labels and streaming services.

Visual artists and literary creators echo these concerns, with over 50% arguing that their work's economic value is systematically underestimated.

Producers, especially those in smaller markets, find themselves in an even more precarious position. Global streaming platforms often retain intellectual property rights, effectively preventing creators from benefiting from future success or reinvesting in new projects.

The legal landscape offers little protection. While recent European Union directives aim to improve transparency and provide contract adjustment mechanisms, enforcement remains weak. Creators are often reluctant to pursue legal action, leaving them vulnerable to exploitative practices.

The study highlights a critical threat to European cultural diversity. With US-based streaming platforms increasingly controlling intellectual property, independent creators and smaller production companies face existential challenges. The research suggests that without significant intervention, Europe risks losing its rich cultural ecosystem to monopolistic corporate practices.

Researchers propose two primary solutions: extending consumer protection-style safeguards to creative professionals and establishing mandatory EU-level rules to protect creators' rights. These recommendations aim to rebalance negotiations and ensure fair compensation across creative industries.

The methodology behind the study is robust, involving 747 survey responses and 91 in-depth interviews across ten European countries. Despite some limitations, particularly in the videogames sector, the research provides a comprehensive snapshot of the current challenges facing creative professionals.

Contracts that transfer creators' rights and underestimate potential economic value

A study on behalf of the Commission has revealed deep-rooted challenges in copyright and IP practices across Europe's creative industries.

In the audiovisual sector, the weak bargaining power of authors is reflected in the contractual terms, which can involve full buy-out contracts with a single lump-sum payment or royalty payments at rates which are perceived as low. In contrast, performers reported an increase in bargaining power because of the increased use of collective bargaining agreements (CBAs) concluded by trade unions.

In the music sector, the survey shows that 41% of authors and performers feel that their bargaining power has remained the same, while 38% report that their bargaining power has decreased over the last five years. Contract negotiations with counterparties, mainly record labels and music publishers, are handled directly by authors and performers (83% of respondents), although 63% of them seek external support from professional organisations, lawyers and CMOs.

Within the visual arts sector, most authors and performers (49%) feel that their individual bargaining power has not changed, while 20% report a decrease. These perceptions may be linked to increased competition, the rise of technology and social media, and the increasing use of artificial intelligence (AI).

In the literary sector, bargaining power is influenced by factors such as an author's success, experience and reputation. Where there is a lack of bargaining power, it is often due to limited resources, lack of support in negotiating contracts and the inherent imbalance of power between publishers and authors. In the literary sector, 78% of authors said that they do not benefit from CBAs and many find these agreements ineffective in some Member States. On the other hand, 68% of the professional organisations representing literary authors said that they benefited from collective agreements.

Practices in the video games sector appear to be different, with negotiations typically taking place at an individual level, with more experienced authors tending to have greater bargaining power.

Rights transfer

In the audiovisual sector, national legislation and specific agreements determine which rights can be transferred and which rights are transferred, resulting in different levels of rights retention and statutory remuneration across Member States. Producers generally acquire broad exploitation rights, while authors and performers retain limited exclusive rights and a non-waivable remuneration.

In the music sector, songwriters often transfer their rights to music publishers and performers often transfer their exclusive rights to record companies. Within the sector, session musicians appear to be in a weaker position than featured performers, who typically receive lump sum payments. Authors and performers in the music sector have generally reported that they face 'take it or leave it' situations in negotiations, particularly with video-on-demand (VOD) services and record companies.

In the visual arts sector, commission contracts are common and can be perceived as problematic as they involve the transfer of ownership and some exploitation rights in exchange for a lump sum payment, with no room for further negotiation.

In the videogames sector, authors typically make a full transfer of rights in perpetuity under employment or subcontracting contracts. In the literary sector, authors typically sign publishing contracts in the form of licence agreements, with buy-outs being less common.

Remuneration

Most authors and performers interviewed or surveyed believe that the remuneration they receive is not fair. In many cases the reasons given relate to the rules around rights transfers (e.g. transfer against lump-sum payments which do not take into account the potential economic value of the works or performances).

In the audiovisual sector, 51% of respondents think that the remuneration is rarely fair, while 33% believe it is never fair, mainly because of the timing of negotiations (pre-production phase), the use of standard industry fees and the lump-sum payment methods.

In the music sector, 49% of music authors and performers responding to the survey consider that the remuneration is rarely fair, while 23% believe that it is never fair. Respondents explained that one reason for the unfair remuneration is that contracts are typically negotiated during the initial stages, before the true economic value of the work can be fully assessed. Additionally, when the remuneration is received in the form of a lump-sum payment, creators may find themselves unable to benefit financially if their work proves to be successful.

Similar trends are perceptible in the visual arts sector, where 51% of respondents consider that the remuneration is rarely fair and 26% think that it is never fair, mentioning as reasons an underestimation of the real or potential economic value of their work and the impact on financial sustainability.

In the literary works sector, 43% of respondents believe that the remuneration is never fair, primarily because the real or potential economic value of the work is disregarded. No conclusive results are available for the videogames sector.

--

Photo source