A survey conducted by the European Commission's Directorate-General for Internal Market, Industry, Entrepreneurship, and SMEs identified the key needs and challenges facing Europe's cultural and creative industries (CCIs). The survey was conducted from 31 January to 23 February 2024, but the results published were published last week. 155 participants across 22 EU countries and 49 respondents operating outside Europe, shed light on the pressing issues confronting this vital sector.

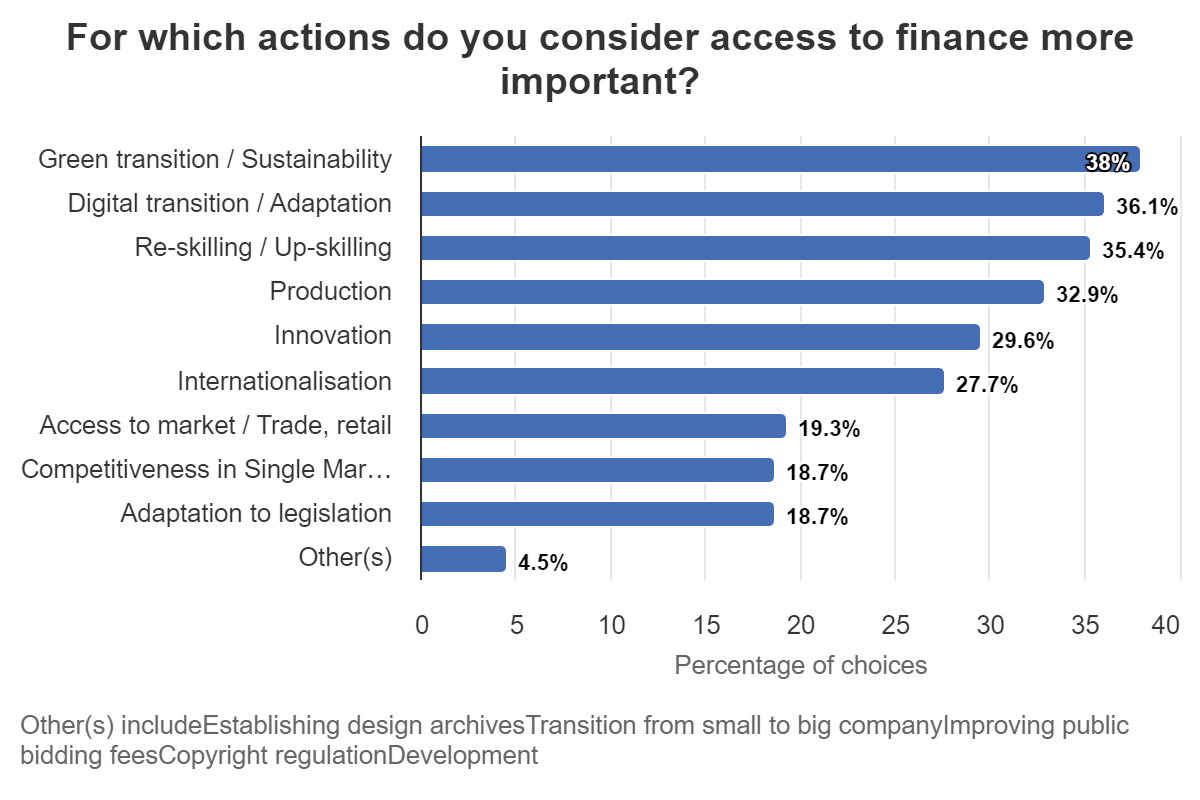

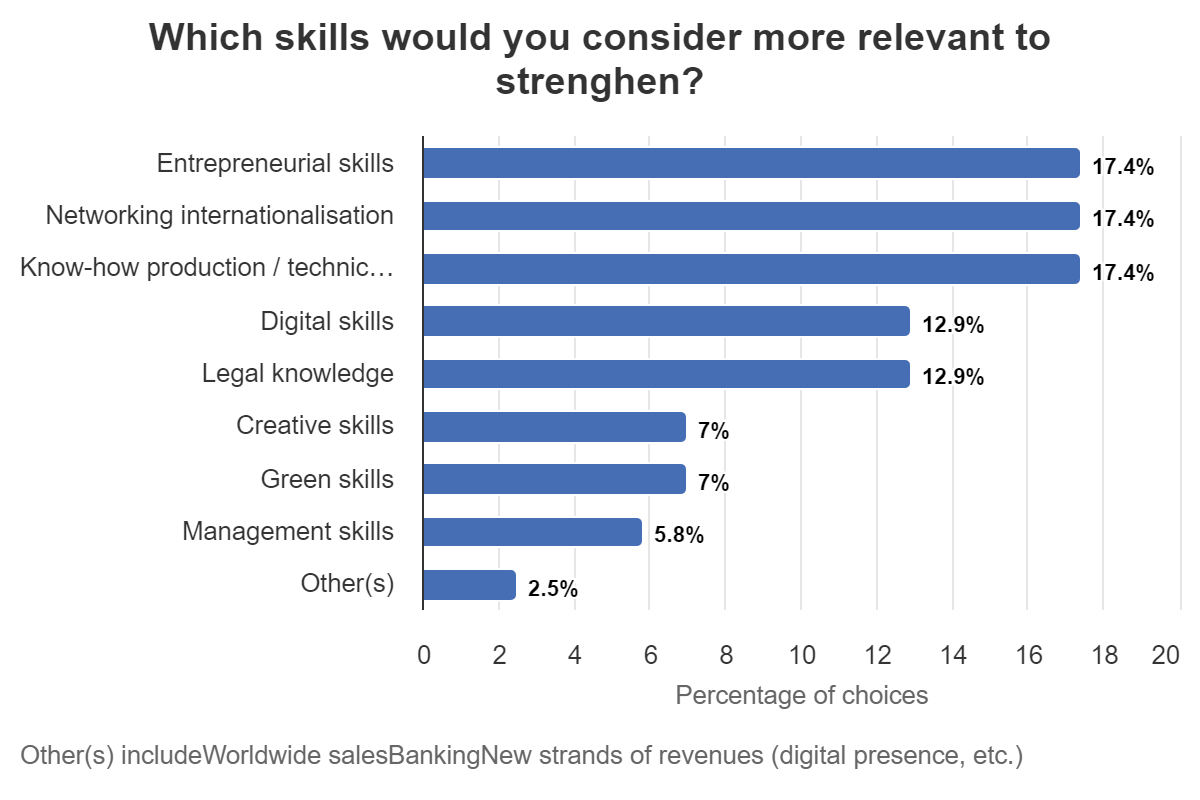

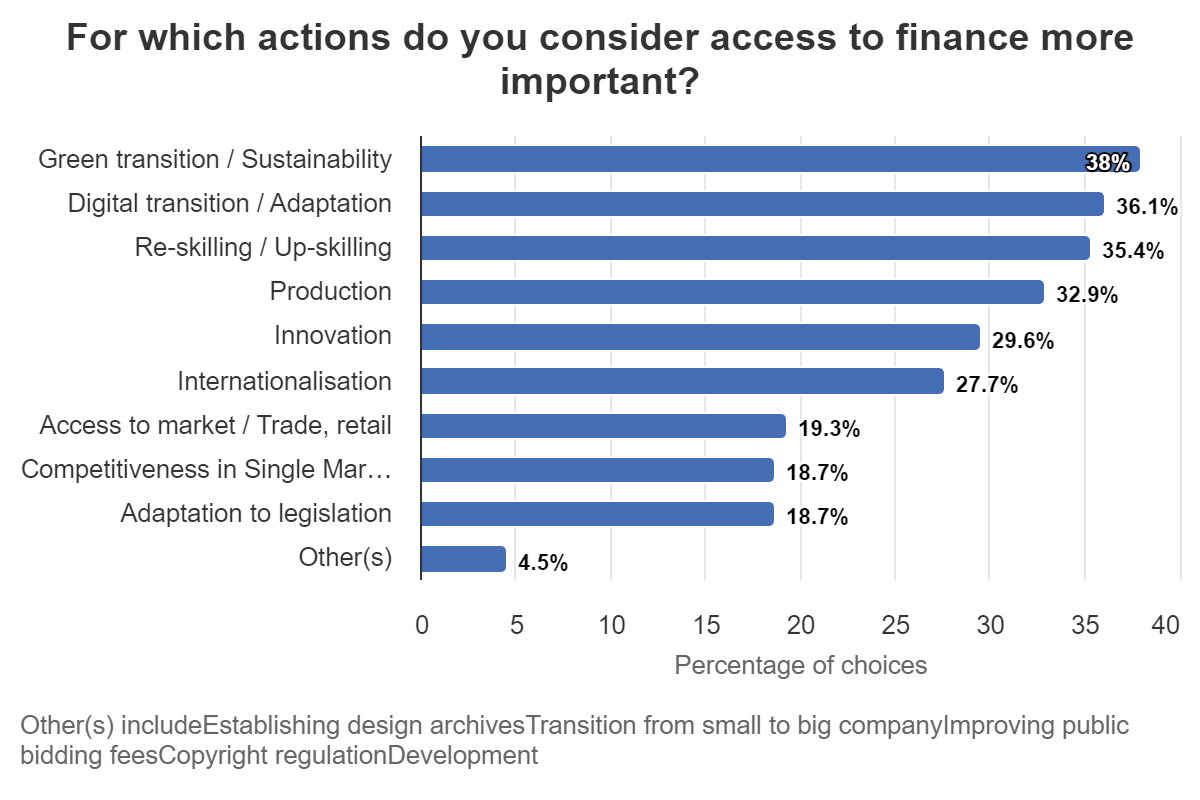

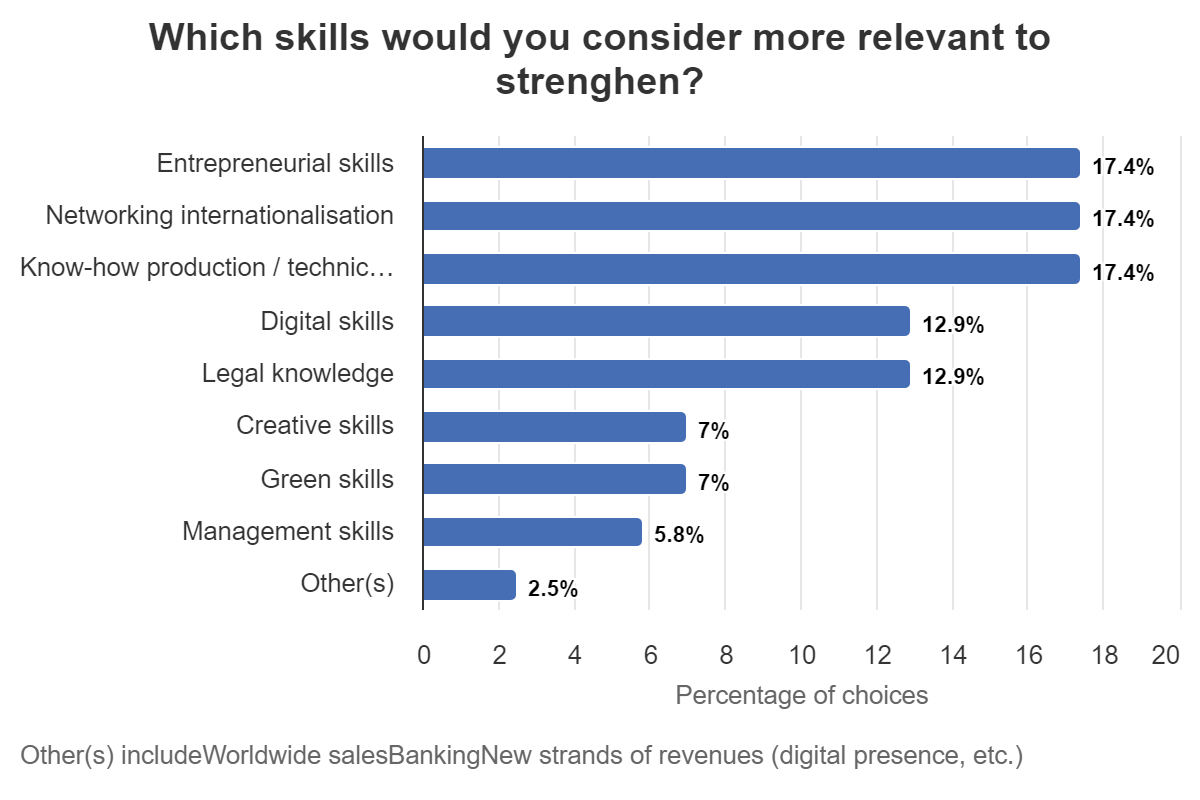

The “most pressing topic” is Access to finance (69%), followed by IPR (27%) and sustainability (23%). When asked for which actions do, respondents consider access to finance more important? The first answer is Greening/sustainability (38%), digital transition follows (36%), and re/upskilling (35%) follows suit. AI is considered the most critical technology for CCI competitiveness in the current landscape (77%) and the skill that most respondents need to develop further is the “entrepreneurial”.

Access to Finance

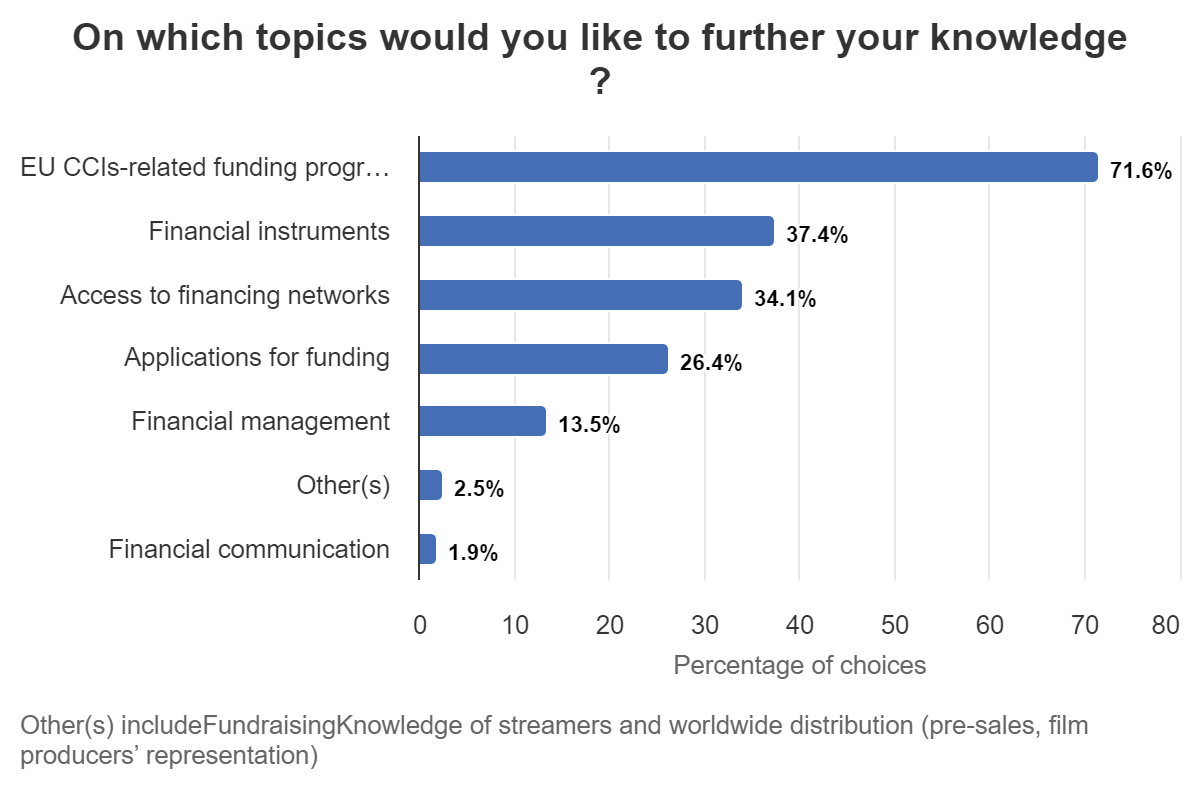

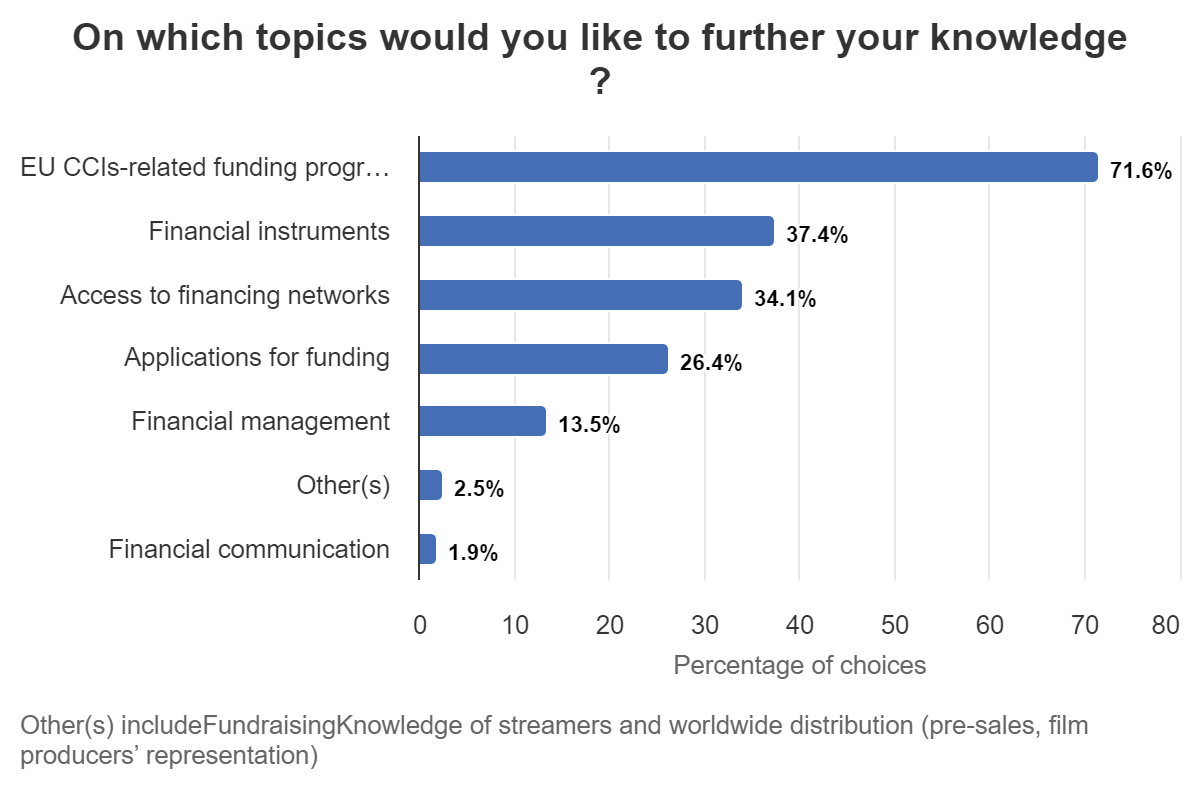

The survey highlights one of the most significant challenges for CCIs: the difficulty they face in accessing adequate financing. Securing the necessary funds to sustain and grow their operations remains a major obstacle for many creative enterprises. What do they need finance for?

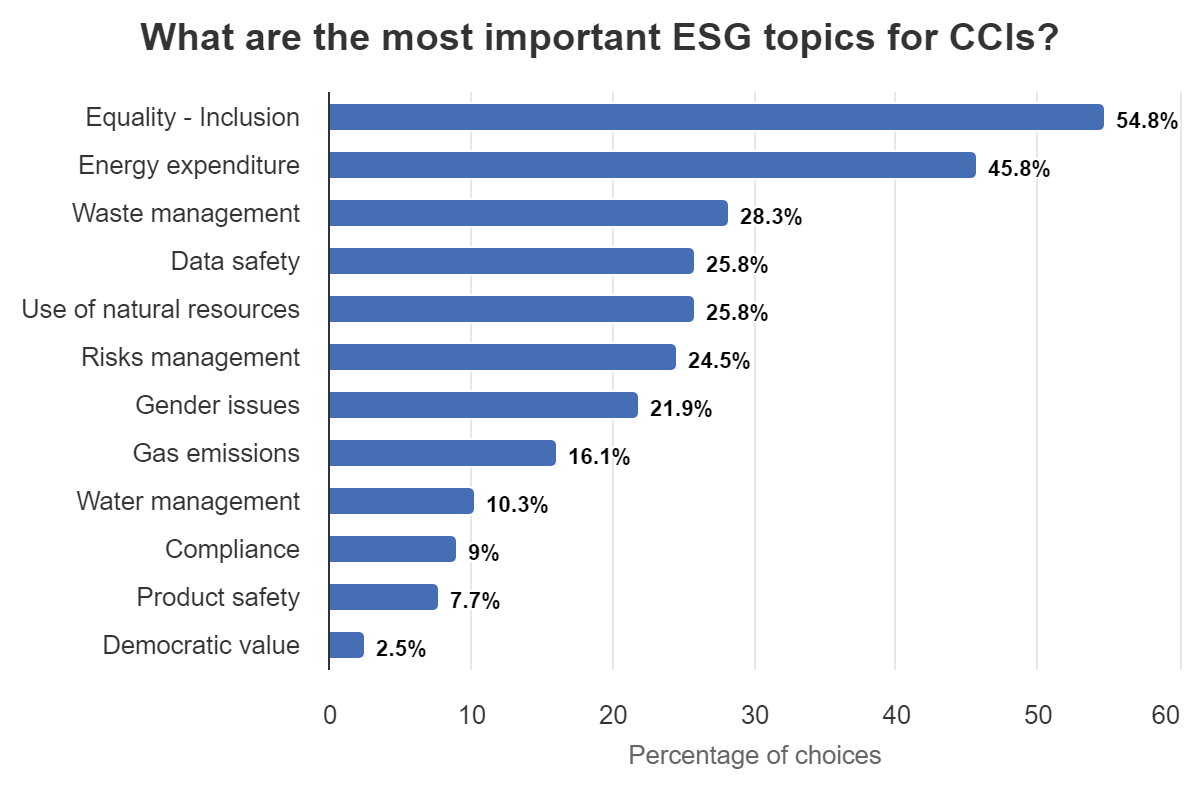

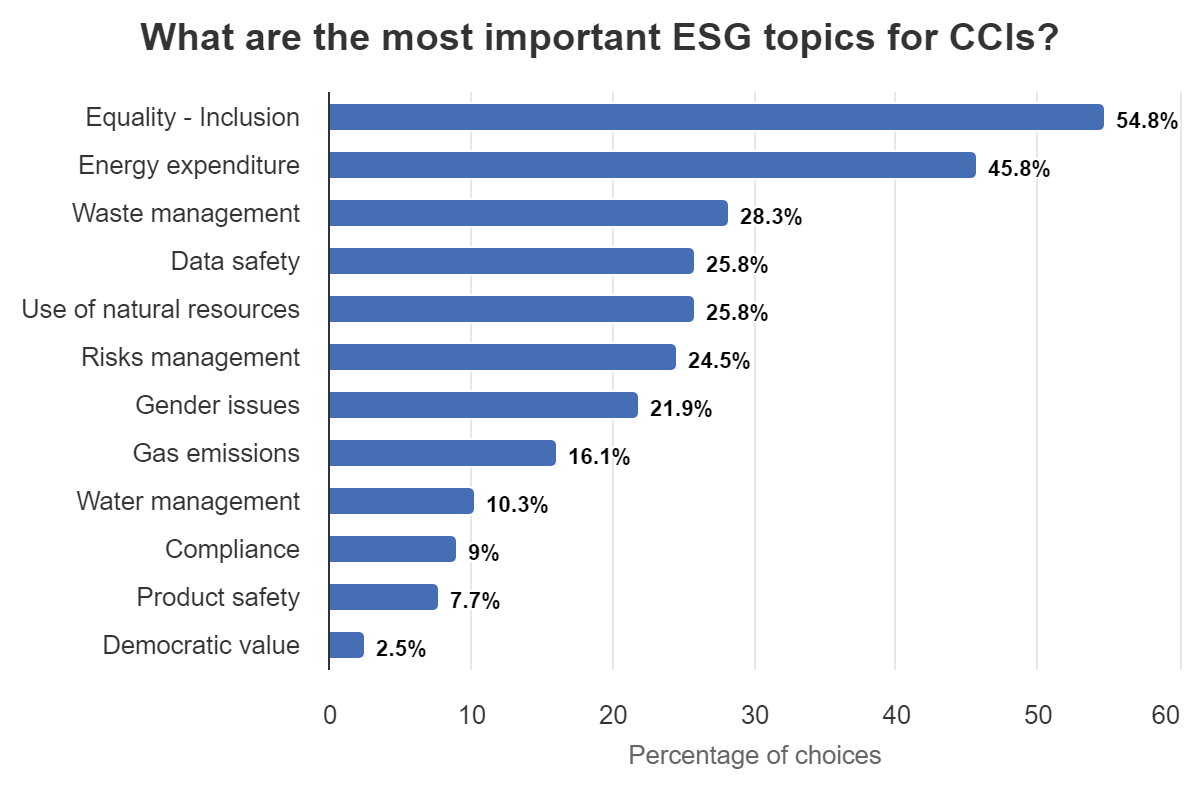

Environmental, Social, and Governance (ESG) Concerns: The survey also revealed that CCIs are grappling with the need to address environmental, social, and governance (ESG) considerations. Integrating sustainable practices and ensuring ethical, transparent, and accountable business operations are emerging as priorities for the sector.

According to the survey, the most pressing challenges faced by Europe's cultural and creative industries are access to finance (69.3%), intellectual property rights (27%), sustainability (23.2%), digitalization (18.7%), and skills shortages (12.9%). Other notable challenges include innovation (10.3%), internationalization (10.3%), and networking (8.3%), while 5.8% of respondents cited other unspecified issues.

--

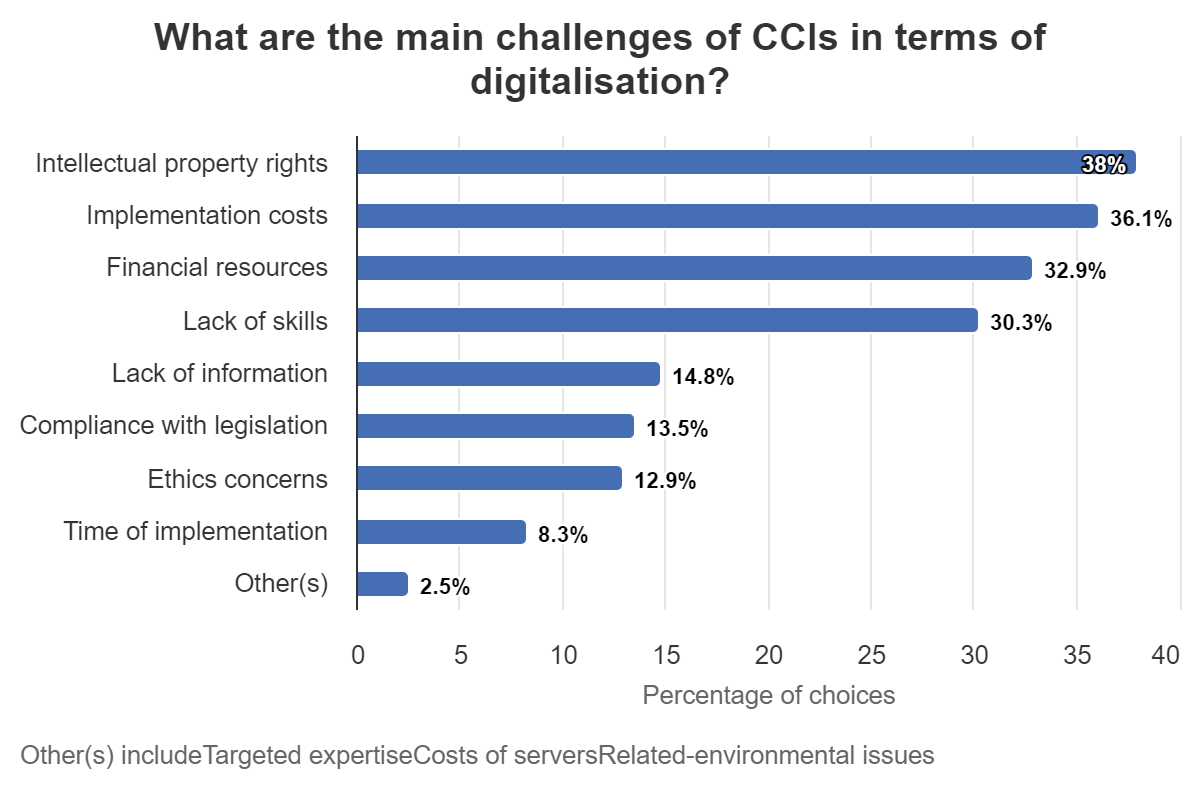

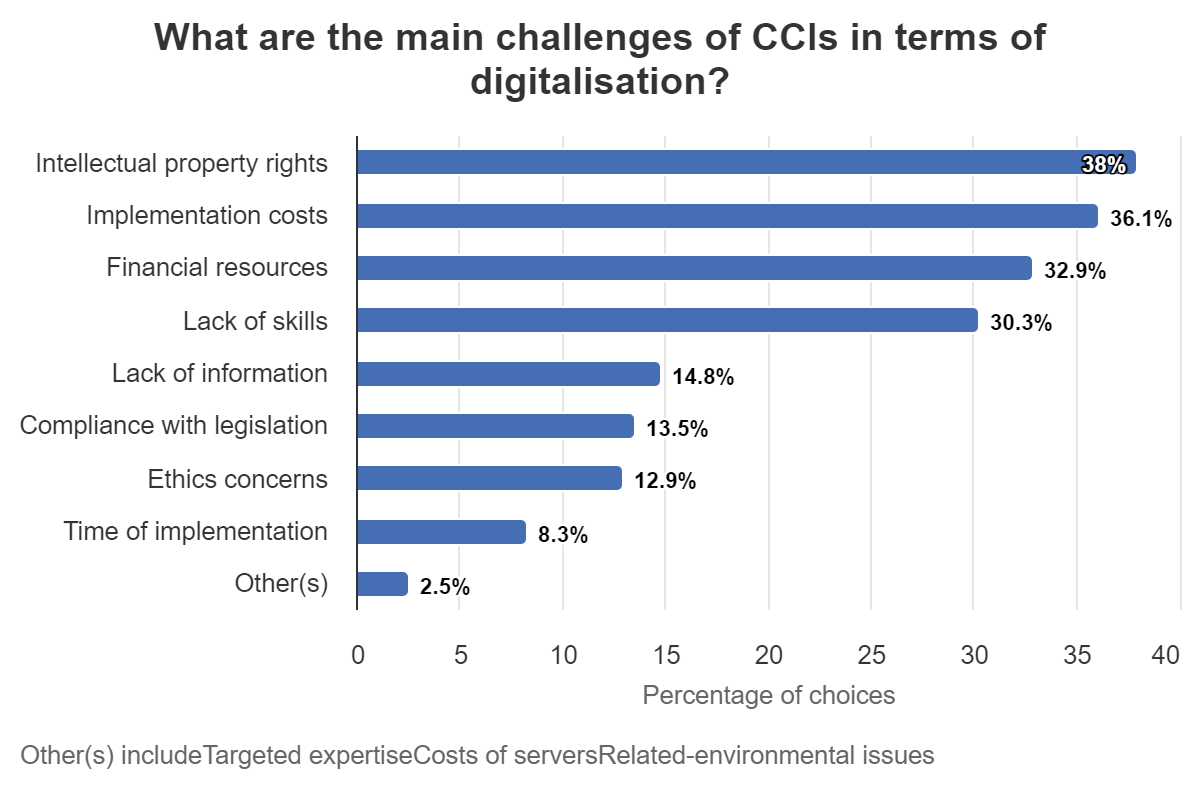

THE CHALLENGE OF DIGITALISATION

The rapid pace of digital transformation poses challenges and opportunities for CCIs. Navigating the complexities of digital technologies, and platforms, and shifting consumer behaviors is a pressing concern for many in the industry. The survey collected data on the specific technologies that CCIs are interested in or planning to adopt. The top technologies mentioned were Artificial Intelligence (77.4%), Cloud Computing (20%), Immersive Virtual Reality (19.3%), Blockchain (18%), 3D and 4D Printing (17.4%), Virtual Worlds (14.8%), Robotics (5.1%), and other technologies (4.5%).

The survey respondents indicated the following as their top challenges and preferences in terms of digitalization: Intellectual property rights (38%), implementation costs (36.1%), financial resources (32.9%), lack of skills (30.3%), lack of information (14.8%), compliance with legislation (13.5%), ethics concerns (12.9%), time of implementation (8.3%), and other challenges (2.5%).

Skills Gaps: The survey also identified skills shortages as a significant challenge. Ensuring that the workforce in the cultural and creative sectors has the necessary expertise, from technical skills to entrepreneurial capabilities, is crucial for the industry's continued growth and innovation.

--

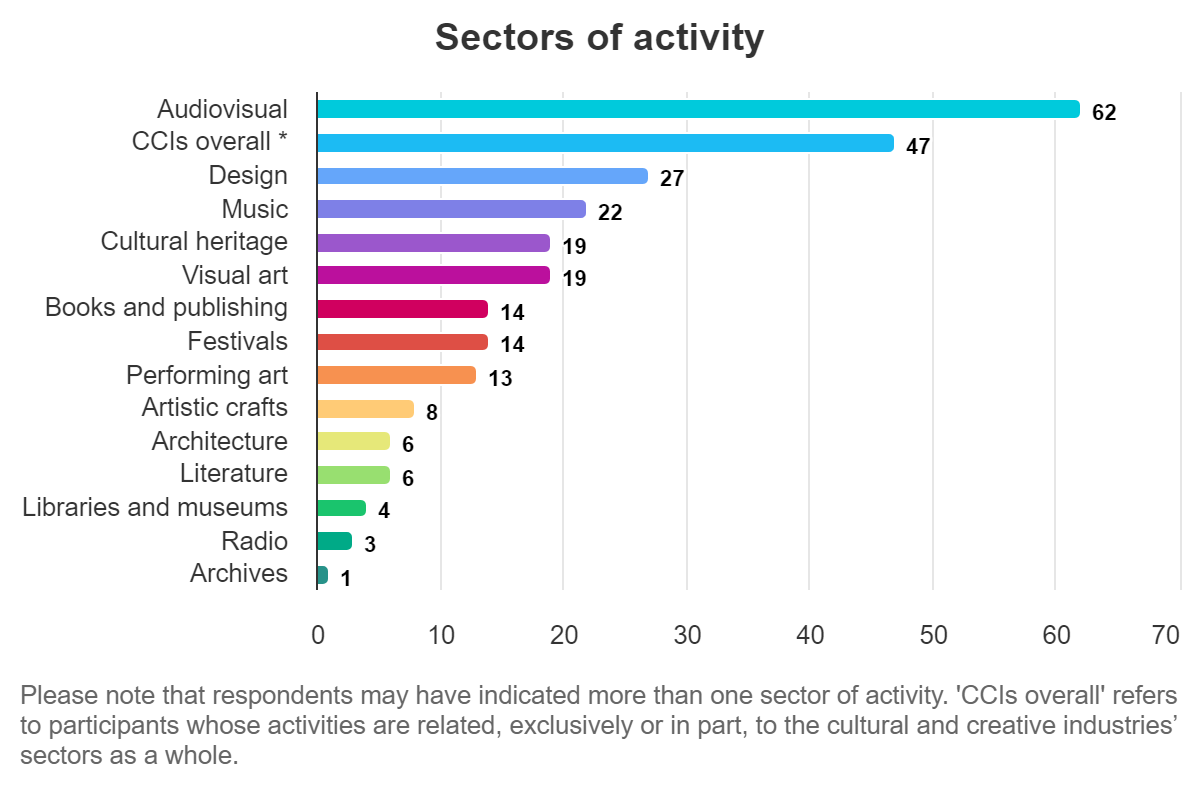

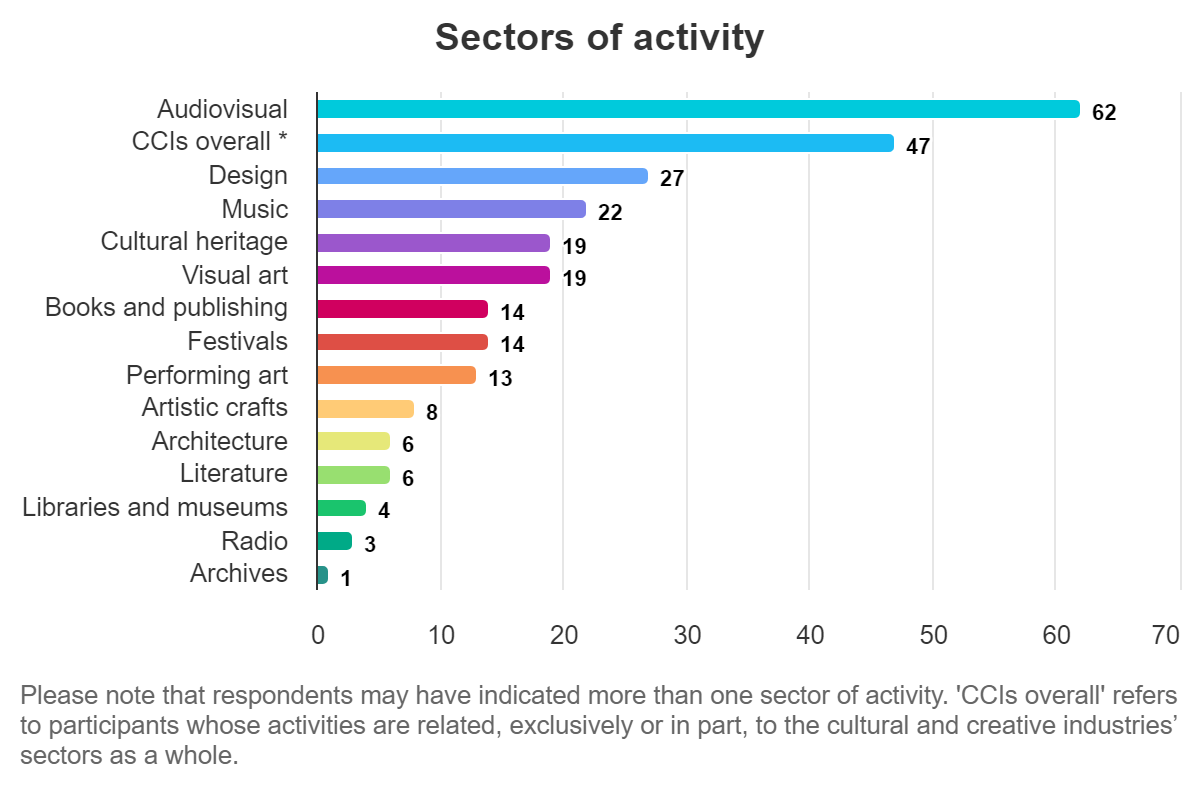

Who are the respondents?

CCIs encompass a wide variety of sub-sectors. This includes architecture, archives, libraries and museums, artistic crafts, audiovisual (including film, television, video games and multimedia), tangible and intangible cultural heritage, design (including fashion design), festivals, music, literature, performing arts, (including theatre and dance), books and publishing, radio, and visual arts.

The cultural and creative industries (CCIs) ecosystem represents approximately 3.95% of EU value added and employs around 8 million people, including around 1.2 million firms, over 99.9% of which are small and medium-sized enterprises (SMEs).

For this survey 51.6% of the respondents operate SMEs, which is the core business model of the sector, 26.4% represent civil society organizations, freelancers, and microfinance schemes 15.4% and 10.4% represent universities. Public companies, public administration, and chambers of commerce represent an additional 20.5% and large company representatives are 5.8%

--